Auto insurance rates are decided after considering several factors and the most prominent of those factors is the driver’s driving record. Insurance providers take into account a driver’s history before renewing insurance rates every year. A tarnished driving history, therefore, converts into higher insurance rates. The logic is that a driving record with moving violations and speeding tickets means the person is more likely to be involved in accidents and the insurance company losing money. Therefore, it is in the best interest of the insurance provider to charge a higher premium from such drivers.

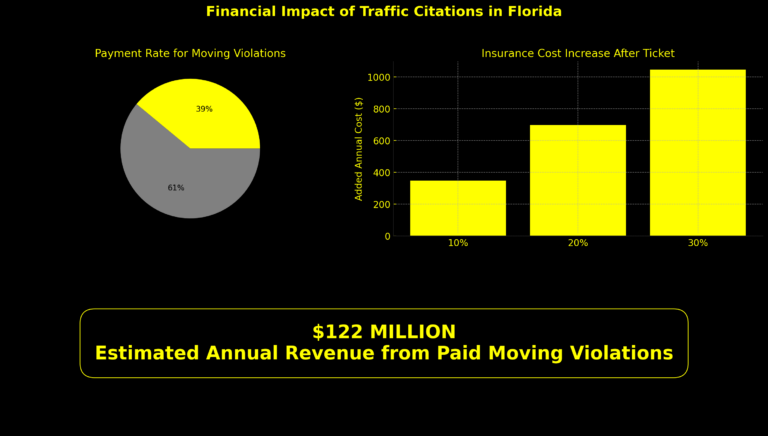

Though there are no accurate calculations as to what extent a particular traffic violation can increase insurance rate, the average rates are as follows:

- DUI – This accounts for nearly 93% premium increase. DUI is one of the most serious offenses and repeats DUI convictions can render a person uninsurable permanently.

- Reckless Driving – This can lead to nearly 82% increase in premiums. Reckless driving in Florida state refers to intentionally breaking traffic rules and causing damage to people and property.

- Careless Driving – About 27% premium hike for unintentionally being risky on the road.

- Speeding and other infractions such as (insert) may result in up to a 40% percent increase for 3-7 years, depending on the insurance company and your record, and other factors, such as age and location of residence.

The best way to avoid higher insurance premiums is to drive safe and to avoid traffic tickets. Just in case you received a traffic ticket or if you happen to be wrongly convicted, do not admit guilt or pay fines before consulting our experienced traffic ticket lawyers, at The Ticket Clinic. Even for a small offense as being charged with running red light camera in Florida or charges as serious as DUI, call us at 1(800) 248-2846 and save money on your insurance premiums.